After a car accident, there are so many things that run through your mind. Things such as physical and emotional pain are usually the first to come to mind but there are also financial burdens that come to play. One of the biggest expenses is if your car needs to be repaired, a rental vehicle.

In this article, we will explore the various options available for covering the expenses of a rental after a car accident, including insurance coverage, the liability of the at-fault party, out-of-pocket payments, and the potential assistance of a car accident attorney.

Who pays for your rental car after a car accident?

After a car accident, the question of who pays for your rental car often depends on the circumstances surrounding the incident. If you are at fault for the accident, you may be responsible for covering the costs of the rental for yourself, unless you have specific insurance coverage that includes rental reimbursement.

Does your car insurance include rental reimbursement coverage?

Many car insurance policies offer an optional coverage called rental reimbursement. This coverage helps pay for the cost of a rental while your vehicle is undergoing repairs due to an accident. It is important to review your insurance policy or contact your insurance provider to determine if you have this coverage and what the specific terms and limits are.

If you have this type of coverage, you can typically submit the rental expenses to your insurance company for reimbursement, up to the specified daily limit and maximum number of days outlined in your policy. Keep in mind that some policies may have a deductible, which means you will need to pay a certain amount out of pocket before the coverage kicks in.

Can I add rental coverage to my car insurance policy after an accident?

Adding rental coverage to your auto insurance policy after an accident may not be possible or may have limitations depending on your car insurance company policy. It is generally recommended to add rental coverage to your policy before an accident occurs. However, it’s still worth reaching out to your provider to inquire about any available options. Here are a few points to consider:

Timing: Adding rental coverage immediately after an accident may raise concerns. They may view it as an attempt to retroactively cover an existing claim, which could result in the denial of coverage. It is best to discuss your specific situation with your insurance provider to understand their policies and any potential options available.

Policy Terms: Review your insurance policy to determine if any provisions allow for the addition of rental coverage after an accident. Some policies may have specific conditions or waiting periods for adding or modifying coverage. It’s important to familiarize yourself with the terms of your policy and contact your insurance provider directly to discuss your options.

Future Coverage: While adding rental coverage after an accident may not be feasible for the current claim, you can discuss the possibility of including it in your policy for future incidents. Your insurance provider can guide you on the available coverage options and any associated costs.

Considerations for Switching Insurance Companies: If your current insurance company does not offer the option to add rental coverage after an accident, you may explore switching to a different insurer. However, keep in mind that switching insurance companies solely to obtain rental car coverage after an accident may not be a guarantee, as new insurers may have similar policies in place.

It’s important to note that insurance policies and their terms can vary significantly between different providers. To get accurate and specific information regarding adding rental coverage after an accident, it is best to contact your insurance company directly. They will have the most up-to-date information on their policies and can provide guidance tailored to your situation.

If the other driver is determined to be at fault for the accident, their insurance company may be responsible for covering the costs of your rental. In such cases, you will typically need to file a claim with the at-fault driver’s insurance company. They will investigate the accident and assess liability before providing you with a rental car or reimbursing you for the rental expenses you have incurred.

It’s important to note that the process of dealing with the other driver’s insurance company can be complex, and they may attempt to minimize their liability or delay the payment. If you encounter difficulties or feel overwhelmed by the negotiation process, it may be beneficial to seek the guidance of an accident attorney who can advocate on your behalf and help ensure you receive fair compensation for your rental expenses.

Can You Pay for Your Rental Car Out of Pocket?

If you have the means to do so, you can choose to pay for your rental car out of pocket after a car accident. This option may be suitable if you do not have rental reimbursement coverage, the at-fault driver’s insurance company is disputing liability, or if you simply prefer to handle the expenses independently.

However, it’s essential to carefully consider the costs involved and evaluate whether paying for a rental out of pocket is financially feasible for you. Rental rates can vary significantly depending on the duration and type of vehicle needed. Additionally, you should also take into account any potential loss of income or productivity if you require a rental for an extended period.

Where Can You Find Rental Car Discounts?

Insurance Providers: Some car insurance companies have partnerships or discounts negotiated with rental agencies, allowing their policyholders to access lower rates. Check with your insurance company to see if they offer any rental discounts.

Membership Organizations: Certain memberships, such as AAA or AARP, often provide discounts on rental cars as part of their benefits packages. If you are a member of any organizations, inquire about potential rental discounts available to you.

Online Travel Agencies: Websites like Expedia, Kayak, or Priceline offer comparison tools that allow you to find competitive rates from multiple rental agencies. Additionally, they may provide promo codes or discounts specific to their platform.

Rental Car Agency Loyalty Programs: Joining loyalty programs offered by agencies can provide you with access to exclusive discounts, upgrades, and other perks. These programs are usually free to join and can offer long-term benefits if you frequently rent cars.

When renting a car, you typically need to provide several documents to complete the rental process. The specific requirements may vary slightly depending on the rental company and the country or region you’re renting in. Here are the common documents you will likely need:

Valid Driver’s License: You must have a valid driver’s license issued by your country or state of residence. The license should be in good standing and not expired. Some rental companies may have additional requirements, such as a minimum age for renting.

Credit Card: A major credit card is usually required for the reservation and payment. The credit card should be in the primary driver’s name and have sufficient funds or credit limit to cover the rental charges, as well as any additional fees or security deposits. Debit cards are sometimes accepted but may have certain restrictions or requirements.

Rental Car Reservation Details: If you made a reservation in advance, bring the confirmation or reservation number provided by the company. This will help expedite the rental process and ensure that you receive the vehicle you booked.

Proof of Insurance: In some cases, you may need to provide proof of insurance coverage. This can be your personal auto insurance policy that extends coverage to rental cars, or you can purchase additional insurance coverage offered by the rental company.

International Driving Permit (if applicable): If you’re renting a car in a country where your driver’s license is not written in the local language, you may need an International Driving Permit (IDP). An IDP is an official translation of your driver’s license and is recognized in many countries as a valid form of identification.

Additional Identification: Depending on the rental company’s policies, you may be asked to provide additional identification documents, such as a passport or a second form of government-issued identification. These documents help verify your identity and confirm your eligibility to rent a car.

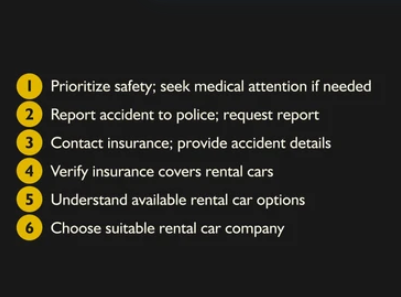

Obtaining a rental after an auto accident can be a necessary step to ensure you have transportation while your vehicle is being repaired. Here are the steps you should take:

Ensure Safety: First and foremost, prioritize your safety and the safety of others involved in the accident. If anyone is injured, immediately call for medical assistance. If it is safe to do so, move your vehicle to the side of the road to prevent further accidents or disruptions.

Contact Authorities: Report the accident to the police and provide them with accurate and detailed information about the incident. This will create an official record of the accident, which may be important for insurance claims and legal purposes.

Exchange Information: Exchange contact and insurance information with the other driver(s) involved in the accident. Collect their name, phone number, address, driver’s license number, license plate number, and insurance details. Similarly, provide them with your information.

Document the Accident: Take photos of the accident scene, including any damage to the vehicles involved. This visual evidence can be valuable when filing insurance claims or seeking legal representation. Additionally, if there are witnesses, ask for their contact information in case their testimony is needed later.

Notify Your Insurance Company: Contact your insurance provider as soon as possible to report the accident and initiate the claims process. Provide them with accurate details about the incident, including the need for a car while your vehicle is being repaired.

Understand Your Insurance Coverage: Review your insurance policy to determine if you have rental reimbursement coverage. If you do, familiarize yourself with the specific terms, limits, and deductibles associated with this coverage. This will help you understand the extent of your benefits.

Determine Liability: If the other driver was at fault for the accident, contact their insurance company to file a claim. Provide them with the necessary documentation, such as the police report, photos, and witness statements, to support your claim for a rental car.

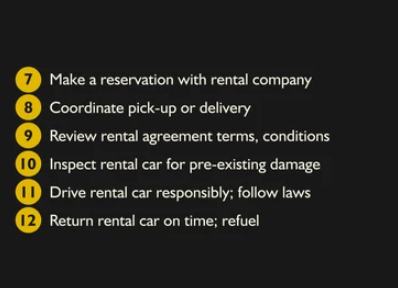

Coordinate with the Insurance Companies: Work closely with your insurance company and, if applicable, the other driver’s insurance company, to coordinate the rental car arrangement. They will guide you through the process, including selecting a rental car provider and arranging for direct billing or reimbursement.

Choose a Provider: If you have rental reimbursement coverage, your insurance company may have preferred rental car providers. However, you can also choose a reputable rental car agency on your own. Consider factors such as proximity, availability, and cost when selecting a rental car provider.

Understand Rental Terms: Before signing any rental car agreement, carefully read and understand the terms and conditions, including insurance coverage, fuel policies, mileage limits, and any additional fees. Ensure that you have adequate insurance coverage for the rental car to protect yourself in case of an accident.

Keep Documentation: Throughout the rental period, keep all relevant documentation, such as rental agreements, receipts, and communications with the insurance companies. This documentation will serve as evidence and help you with reimbursement or any potential legal proceedings.

Remember, it’s crucial to consult with your insurance provider and, if needed, an accident attorney to fully understand your rights and options regarding a rental car after an auto accident. They can provide personalized guidance based on your specific circumstances and help protect your interests throughout the process.

How Can an Accident Attorney Help Me After a Car Accident?

Engaging the services of an accident attorney can be beneficial in navigating the complex legal and insurance processes following a car accident. An attorney experienced in personal injury and accident cases can provide the following assistance:

Insurance Claim Assistance: An attorney can help you file a claim with your own insurance company, ensuring that you receive the maximum benefits entitled to you under your policy. They can also handle negotiations with the at-fault driver’s insurance company, ensuring you receive fair compensation for your rental expenses.

Liability Determination: In cases where liability is disputed, an attorney can gather evidence, interview witnesses, and work with accident reconstruction experts to establish the fault of the other party. This can be crucial in holding the at-fault driver responsible for your rental expenses.

Legal Representation: If negotiations with insurance companies fail to reach a satisfactory resolution, an accident attorney can file a lawsuit on your behalf. They will guide you through the legal process, represent your interests in court, and seek compensation for your rental expenses as part of your overall personal injury claim.

Dealing with the financial aspects of a rental after a car accident can add another layer of stress to an already challenging situation. Understanding the options available to you, such as rental reimbursement coverage, the liability of the at-fault party, out-of-pocket payments, and rental car discounts, can help alleviate some of the financial burdens. Furthermore, enlisting the assistance of an accident attorney like those at Demesmin and Dover Law Firm can provide valuable guidance and representation to ensure you receive fair compensation.

So if you or a loved one have been in an accident contact the experienced car accident attorneys at Demesmin and Dover today. Call 866-954-MORE (6673) for your free consultation.